DEMON•OCRACY.INFO is a site that proclaims itself to be devoted to economic infographics; you may have seen some of their work previously. Well, now they have a page that outlines the problem with derivative trading, and it's really, really scary to look at. Click on the link to check these illustrations.

WHY SHOULD YOU CARE? Well, there might not be much you can do about it, but at least you can be aware of the giant trap-door that could spring at any time (remember, we have never lived in an electronic economy before, and nobody knows what the rules really are, for how it really works), and maybe, just maybe, start organizing those around you to work for change.

What's a derivative?

A derivative is a legal bet (contract) that derives its value from another asset, such as the future or current value of oil, government bonds or anything else. Ex- A derivative buys you the option (but not obligation) to buy oil in 6 months for today's price/any agreed price, hoping that oil will cost more in future. (I'll bet you it'll cost more in 6 months). Derivative can also be used as insurance, betting that a loan will or won't default before a given date. So its a big betting system, like a Casino, but instead of betting on cards and roulette, you bet on future values and performance of practically anything that holds value. The system is not regulated what-so-ever, and you can buy a derivative on an existing derivative.

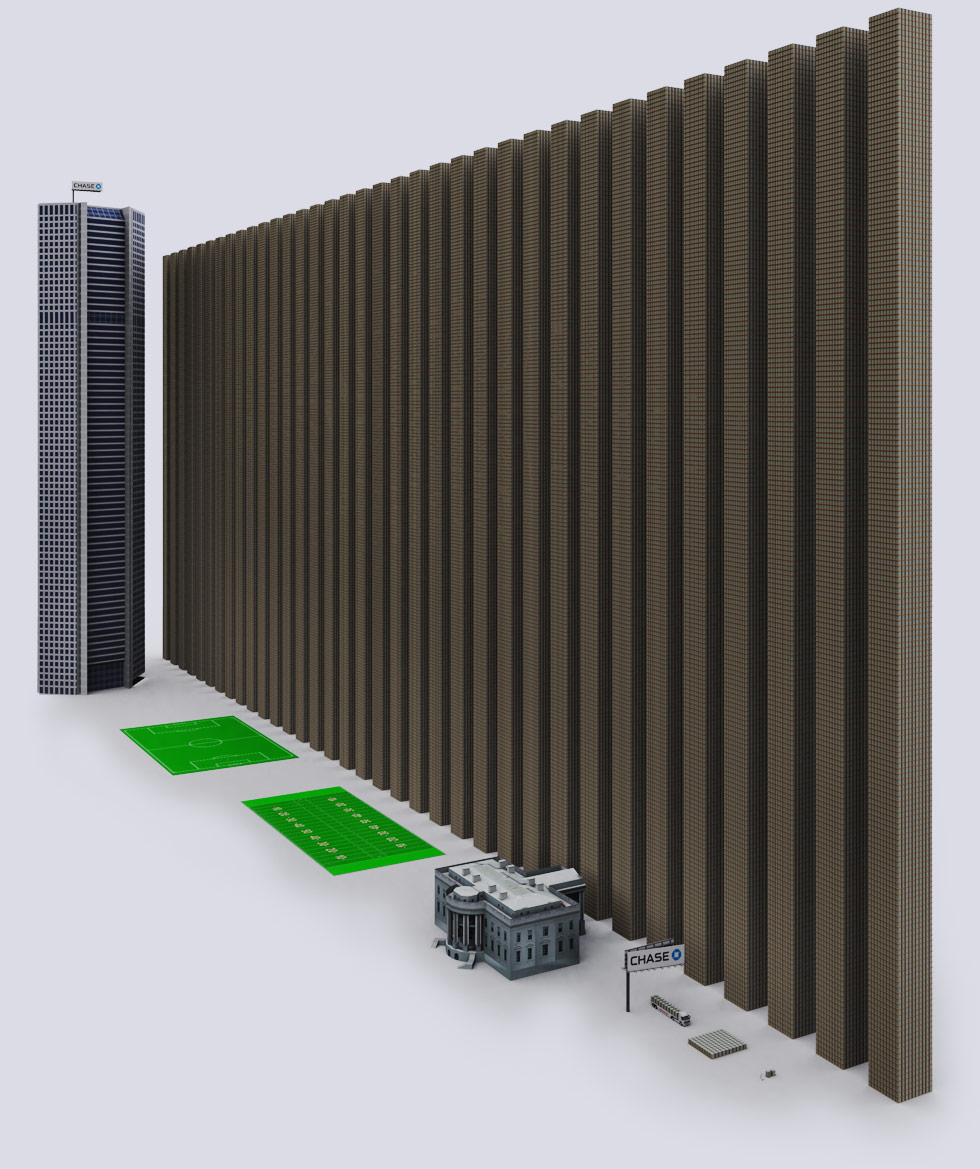

Most large banks try to prevent smaller investors from gaining access to the derivative market on the basis of there being too much risk. Deriv. market has blown a galactic bubble, just like the real estate bubble or stock market bubble (that's going on right now). Since there is literally no economist in the world that knows exactly how the derivative money flows or how the system works, while derivatives are traded in microseconds by computers, we really don't know what will trigger the crash, or when it will happen, but considering the global financial crisis this system is in for tough times, that will be catastrophic for the world financial system since the 9 largest banks shown below hold a total of $228.72 trillion in Derivatives - Approximately 3 times the entire world economy. No government in world has money for this bailout.

Most large banks try to prevent smaller investors from gaining access to the derivative market on the basis of there being too much risk. Deriv. market has blown a galactic bubble, just like the real estate bubble or stock market bubble (that's going on right now). Since there is literally no economist in the world that knows exactly how the derivative money flows or how the system works, while derivatives are traded in microseconds by computers, we really don't know what will trigger the crash, or when it will happen, but considering the global financial crisis this system is in for tough times, that will be catastrophic for the world financial system since the 9 largest banks shown below hold a total of $228.72 trillion in Derivatives - Approximately 3 times the entire world economy. No government in world has money for this bailout.

H/T with special thanks to Harold at Frenchman's Bay.

2 comments:

I saw this post in Zero Hedge. Every day something equally troubling is posted there. It got me to thinking aboot what to do, a derivative planning exercise. There is a shit storm comming, we live in a country well equipped to muddle through, but we are sadly lacking leadership, and are dangerously complacent.

From the outset of the 2008 global meltdown I argued that the United States and other affected governments really needed to declare derivatives, especially credit default swaps, null and void.

The reason is simple. These instruments were always bogus and everyone pretty much knew it. Those who sold CDS knew if they were called they had nowhere remotely near the assets needed to make good their promises. Those who bought them, likewise, knew or ought to have known the very same thing. If I sell an undertaking I know I cannot fulfill and you buy it knowing I'm not good for all these undertakings if they're called and if these bogus instruments threaten to destabilize the economy, or worse, then why should governments not legislate them null and void?

Around the world we have been pledging taxpayer credit to bail out improvident deals when we should have let the wheeler dealers eat their losses. For example the Irish government intervened to make good the nation's banks to their bondholders, putting that debt on the back of the Irish people. What they could have and should have done is guarantee the savings accounts of the Irish public and allow the banks and bondholders to sort out their own mess. They chose, instead, to bail out the banks, not the public.

Post a Comment